Standard Deviation Mean Reversion . By understanding the foundations and assumptions of mean reversion, such as probability, standard deviation, variance, equilibrium, and the emh, financial analysts can. Here, the further the standard deviation. For example, bollinger bands use standard deviation to measure how far a price is from the mean. The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average. Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price.

from www.youtube.com

Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: By understanding the foundations and assumptions of mean reversion, such as probability, standard deviation, variance, equilibrium, and the emh, financial analysts can. For example, bollinger bands use standard deviation to measure how far a price is from the mean. Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price. Here, the further the standard deviation. The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average.

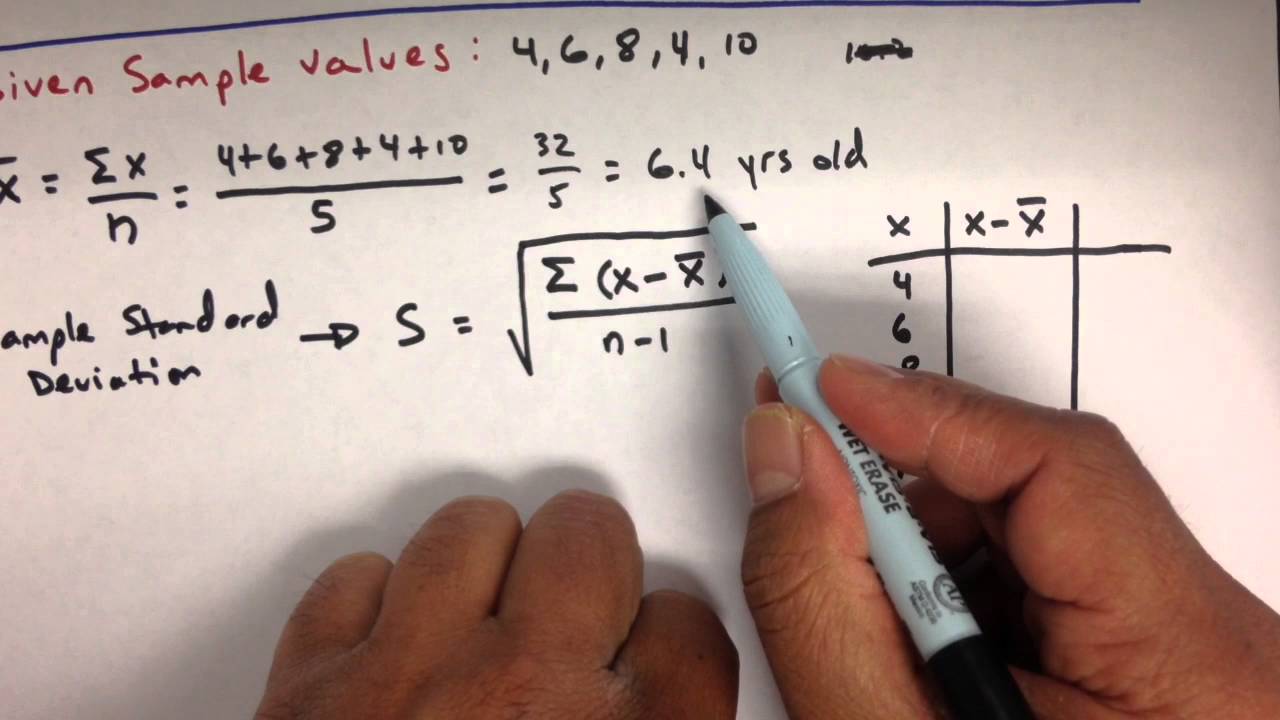

Variance and Standard Deviation Sample and Population Practice

Standard Deviation Mean Reversion For example, bollinger bands use standard deviation to measure how far a price is from the mean. For example, bollinger bands use standard deviation to measure how far a price is from the mean. Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price. Here, the further the standard deviation. By understanding the foundations and assumptions of mean reversion, such as probability, standard deviation, variance, equilibrium, and the emh, financial analysts can. The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average.

From tradingstrategyguides.com

Mean Reversion Trading Strategy With A Sneaky Secret Standard Deviation Mean Reversion Here, the further the standard deviation. For example, bollinger bands use standard deviation to measure how far a price is from the mean. By understanding the foundations and assumptions of mean reversion, such as probability, standard deviation, variance, equilibrium, and the emh, financial analysts can. The mean reversion trading strategy suggests prices and returns eventually move back toward the mean. Standard Deviation Mean Reversion.

From efinancemanagement.com

Mean Reversion Meaning, Indicators & Strategies eFM Standard Deviation Mean Reversion Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. By understanding the foundations and assumptions of mean reversion, such as probability, standard deviation, variance, equilibrium, and the emh, financial analysts can. Here, the further the standard deviation. Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price. The. Standard Deviation Mean Reversion.

From www.goodreads.com

MEAN REVERSION STRATEGY Learn how to trade a Pullback trading strategy Standard Deviation Mean Reversion Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average. For example, bollinger bands use standard deviation to measure how far a price is from the mean. Here, the further the standard deviation.. Standard Deviation Mean Reversion.

From www.slideshare.net

Standard Deviation BreakDown SUBTRACT THE Standard Deviation Mean Reversion Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price. Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: Here, the further the standard deviation. For example, bollinger bands use standard deviation to measure how far a price is from the mean. Mean. Standard Deviation Mean Reversion.

From www.youtube.com

Variance and Standard Deviation Sample and Population Practice Standard Deviation Mean Reversion Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: By understanding the foundations and assumptions of mean reversion, such as probability, standard deviation, variance, equilibrium, and the emh, financial analysts can. For example, bollinger bands use standard deviation to measure how far a price is from the mean. Mean. Standard Deviation Mean Reversion.

From blog.roboforex.com

Mean Reversion Trading Strategy Mean Reversion Channel Indicator Standard Deviation Mean Reversion Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price. Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. For example, bollinger bands use standard deviation to measure how far a price is from the mean. Standard deviation = square root of [(the sum of deviations squared) ÷. Standard Deviation Mean Reversion.

From www.wintwealth.com

Standard Deviation in Mutual Funds Meaning, Calculation and More Details Standard Deviation Mean Reversion Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. Here, the further the standard deviation. For example, bollinger bands use standard deviation to measure how far a price is from the mean. The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average. Standard deviation = square root. Standard Deviation Mean Reversion.

From www.youtube.com

Mean, Variance and Standard Deviation for Grouped and Ungrouped Data Standard Deviation Mean Reversion Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price. Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. By understanding the foundations and assumptions of mean reversion,. Standard Deviation Mean Reversion.

From www.scribd.com

Mean, Median, Mode and Standard Deviation PDF Standard Deviation Mean Standard Deviation Mean Reversion Here, the further the standard deviation. The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average. Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price. By understanding the foundations and assumptions of mean reversion, such as probability, standard deviation, variance, equilibrium, and the emh, financial analysts. Standard Deviation Mean Reversion.

From tradingkit.net

Maximizing Forex Profits with Mean Reversion and Indicators. Standard Deviation Mean Reversion For example, bollinger bands use standard deviation to measure how far a price is from the mean. Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. Here, the further the standard deviation. Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: Mean reversion. Standard Deviation Mean Reversion.

From www.marcocasario.com

La teoria del Mean Reversion Standard Deviation Mean Reversion Here, the further the standard deviation. Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average. Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. Mean reversion. Standard Deviation Mean Reversion.

From analystprep.com

The Mean Reversion CFA, FRM, and Actuarial Exams Study Notes Standard Deviation Mean Reversion Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. By understanding the foundations and assumptions of mean reversion, such as probability, standard deviation, variance, equilibrium, and the emh, financial analysts can. Mean reversion trading. Standard Deviation Mean Reversion.

From www.wikihow.com

How to Calculate Standard Deviation 12 Steps (with Pictures) Standard Deviation Mean Reversion By understanding the foundations and assumptions of mean reversion, such as probability, standard deviation, variance, equilibrium, and the emh, financial analysts can. Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price. The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average. Mean reversion posits that asset. Standard Deviation Mean Reversion.

From www.marketcalls.in

Linear Regression based Mean Reversion Strategy Standard Deviation Mean Reversion Here, the further the standard deviation. Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average. Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price. Standard deviation = square root of. Standard Deviation Mean Reversion.

From www.tradinformed.com

A Simple RSI Mean Reversion Strategy Tradinformed Standard Deviation Mean Reversion The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average. Here, the further the standard deviation. Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: By understanding the foundations and assumptions of mean reversion, such as probability, standard deviation, variance, equilibrium, and. Standard Deviation Mean Reversion.

From www.businesser.net

How To Find Standard Deviation In Finance businesser Standard Deviation Mean Reversion For example, bollinger bands use standard deviation to measure how far a price is from the mean. Mean reversion posits that asset prices and market returns eventually gravitate toward their historical averages. Here, the further the standard deviation. Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price. Standard deviation = square root of. Standard Deviation Mean Reversion.

From www.morpher.com

Mean Reversion Strategies Morpher Standard Deviation Mean Reversion Standard deviation = square root of [(the sum of deviations squared) ÷ (the number of observations — 1)] step 4: Here, the further the standard deviation. The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average. For example, bollinger bands use standard deviation to measure how far a price is from the mean.. Standard Deviation Mean Reversion.

From forestparkgolfcourse.com

Standard Deviation Formula and Uses vs. Variance (2024) Standard Deviation Mean Reversion Here, the further the standard deviation. For example, bollinger bands use standard deviation to measure how far a price is from the mean. Mean reversion trading strategies involve identifying assets that have deviated significantly from their historical average price. The mean reversion trading strategy suggests prices and returns eventually move back toward the mean or average. By understanding the foundations. Standard Deviation Mean Reversion.